In-house V.S. SaaS: Should You Build Your Own Affiliate Fraud Prevention Tool?

FraudScore Partner post by Affise — a performance marketing platform helping advertisers all around the globe to manage, track, analyse and optimize online advertising campaigns in real-time.

One of the biggest challenges when running an affiliate program is fraud. Affiliate marketing fairly quickly took off and attracted a lot of finances, so that it eventually became attractive for online fraudsters. The newest Affise’s report on Fraud in Affiliate Marketing reveals the statistics from WARC showing that almost $560 billion was spent globally on digital advertising in 2018, and these figures are expected to grow by at least 13% by 2022.

With these numbers, it’s of no surprise why fraudsters are so inventive on the creation of new fraud strategies. Even though there are several recommendations that marketers need to follow to protect their campaigns, with the level of sophistication fraudsters put into new fraudulent methods, these recommendations won’t provide you with complete fraud protection. Nowadays marketers can’t do without an additional tool based on an ML-methodology which analyzes all metrics and connections and blocks fraudulent patterns.

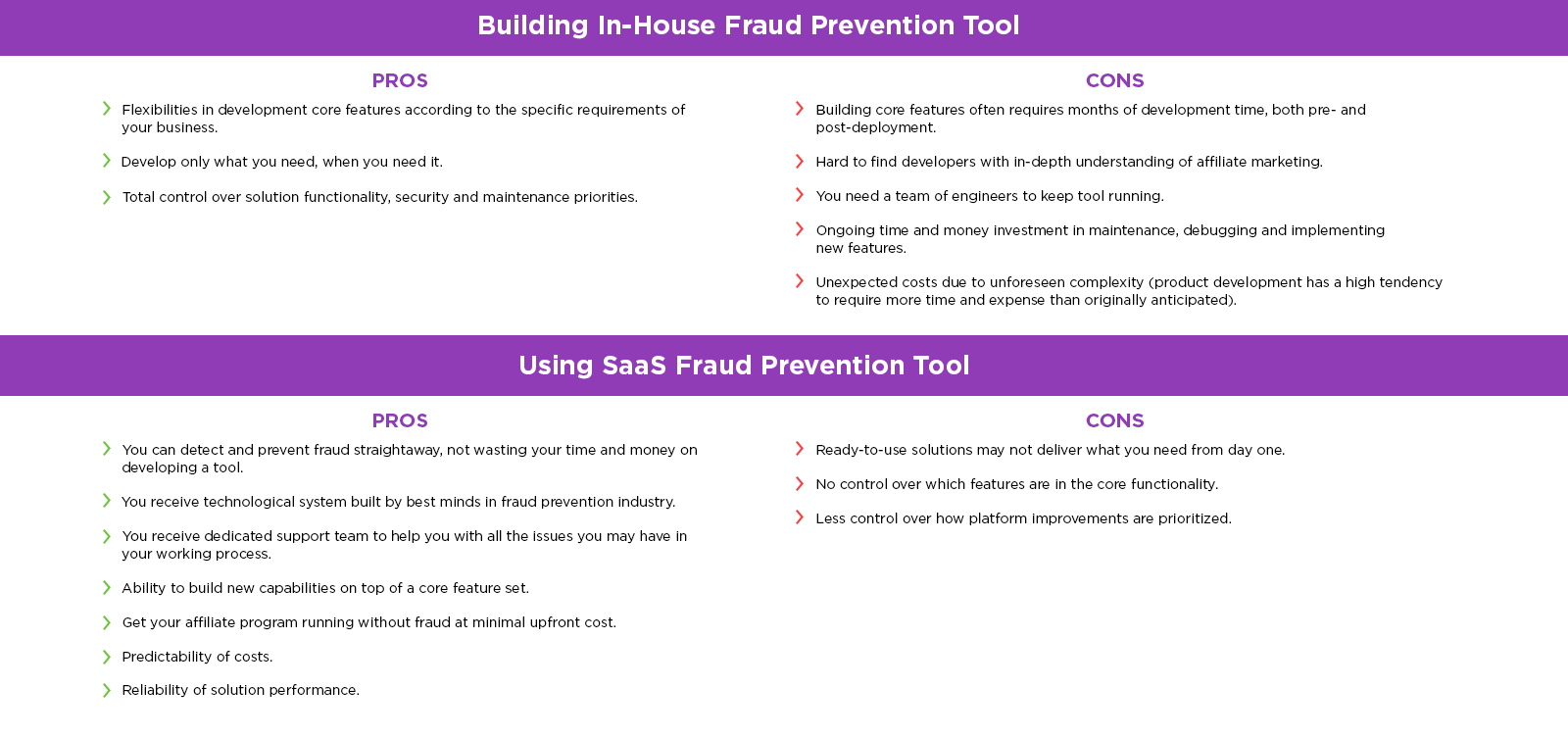

To detect and prevent fraud properly you may either develop core capabilities in-house, or use a ready-to-use SaaS solutions. For advertisers and networks, it’s a decision with the direct impact on short and long-term business growth.

In-house or SaaS?

When comparing in-house and SaaS fraud prevention solutions, the main criteria are a maintenance, staffing, competence and intelligence, agility, integrations and customization, data privacy, the accuracy of fraud prevention and price. Let’s take a closer look at them.

Maintenance and Staffing

In-house

With your custom-made solution, you keep everything under control. You have your team, who knows the product backwards and forwards, and they are the ones responsible for all updates. In this way, you don’t need to attract any external specialists. On the backside, it’s super human resources-heavy. Having your team working on maintaining a fraud prevention tool will inevitably create a tiresome and lengthy hiring process to find the right professionals. Further, you need to ensure thorough non-disclosure agreements for technology information not to get leaked in case somebody leaves.

SaaS

You are exempted from a large piece of work maintaining the technology. Since an outsourced provider handles all updates, bug fixes and releases, there is little for your company left to do but monitor the results. Consequently, you also do not need to look for additional personnel. It comes as a part of a fraud prevention package. You don’t need to hire anyone, besides, perhaps, a fraud prevention manager. And this is one huge headache less: you don’t think about employees compensation and taxes, their insurance and holidays. And besides, you always have people supporting your platform.

Сompetence & Intelligence

In-house

In-house teams have an advantage when it comes to business operations and product knowledge. No matter how good an outsourcing provider is, employees always know their business better. In such a way, in-house experts team can easily anticipate fraudulent patterns and adjust accordingly in the early stages.

SaaS

Thanks to a tremendous experience of combating fraud in diverse industries, ready-to-scale fraud prevention tools are very skilled at understanding the evolving threats associated with various businesses. You can choose among those that work primarily with the same types of business as yours. Hence you can rely on them providing fraud protection to your business.

Agility

In-house & SaaS

Less agile for sudden spikes. In case of sudden fraud attacks, in-house solutions are far less agile than a professional with limitless resources. When fraud spikes unexpectedly or a new type of fraud arises, outsourced solutions are much better equipped to deal with the high-risk.

Integrations & Customization

In-house

No integration hassle. It’s tailored for you. Since the solution is purpose-built from scratch within your system, starting with it should be seamlessly and fast. It is already programmed for your business purposes and to this end connected with necessary service providers.

SaaS

Customization might be harder, or costly. Depending on what you need, you might have to wait for a provider to release a new feature. To avoid being in a situation like that, make sure that the system you choose is flexible enough. Primarily that means paying attention to already integrated services and customization possibilities, as well as checking in advance the API documentation. On the other hand, modern tools are developed with all business aspects in mind. Further, most of the SaaS fraud prevention tools are already integrated with the most popular services, that marketers are likely to need for workflow automation. And even if they don’t, it is not a problem to conduct an additional integration.

Data Privacy

Inhouse

With an in-house solution, you are more secure when it comes to personal data storage. No third parties receive the data that you process as it is directly handled in-house. With the personal data not leaving your premises, it’s one less headache for a business, a massive headache! However, you if you have a dedicated IT staff working for you, you continuously need to train them on changes to cybersecurity and Data Privacy.

SaaS

Modern companies approach the necessity to comply with all legal directives very seriously. No company would risk getting in trouble because of noncompliance with GDPR. Cooperation contracts adequately address data protection issues and ensure the safety of your data. However, it’s your responsibility to decide which data to provide to the vendor, which capacity the involved parties have concerning this data, and how to transfer it on legitimate grounds. For the latter, you need to make sure that all data processing activities comply in all respects with the EU Directive, U.S. laws, and with domestic legislative equivalents in specific jurisdictions.

Accuracy of fraud-prevention

Inhouse

For ensuring the accuracy of your fraud prevention solution, you’ll need to aggregate data from various sources. For this purpose, anyway, you need to integrate middleware platforms, which, for its turn, defeats the purpose of insourcing in terms of data security.

SaaS

Broad array of data aggregation. Dedicated fraud prevention tools accumulate a lot of data and share attack patterns from numerous sources, allowing for a higher success rate.

Cost

In-house

Even though there is no incremental cost per transaction, the final cost is still hard to predict, you are responsible for the whole technology. To estimate the final expenditure of fraud prevention, you need to sum up all technical costs, unpredictable expenses in case of breakage or updates, and further consider employee costs: salaries, taxes, insurance, training, sick leaves and vacation etc.

SaaS

Using SaaS fraud prevention tool, you get a flat-fee monthly payment. Cost is pegged to volume and payment plans, ensuring full transparency. You can predict your expenses and the resulting ROI based on the evaluation of your spending on fraud prevention in proportion to sales volume.

Inhouse V.S. SaaS: Results

As you can see, there are a lot of factors to consider. And while leaning toward the idea of a custom in-house solution requires a full cycle of business analysis and technology development, it will take less time to analyze the possibilities that SaaS tools provide.

Affise’s report on Fraud in Affiliate Marketing — in the report you will also find the most recent information about fraud state in 2019, the forecast for the upcoming years, ways how to fight fraud as well as detailed overview of the top SaaS fraud prevention tools, with FraudScore being among them. Download the report here.

Dmitry Isakov, FraudScore CEO: “When it comes to making a choice between SaaS providers, we always recommend to compare different solutions. Take your traffic to several companies and ask for free trial. How to know which companies? Ask your colleagues and partners in the industry for advice — they probably already know which solutions are worth looking at.

When you’ve made a choice which services to trial — check for the depth and usability of fraud reports — you need to understand where fraud was detected, why, and will you be able to explain it to your partners based on the reports. Then, check for technologies and prevention and detection approach — which stages of ad funnel can a solution cover? Does it satisfy your fraud protection needs? The most important — ask a solution’s team for consultation and help in understanding fraud reports and negotiations. A good SaaS provider understands that you are not a guru in ad fraud fight, and will help you read the reports, understand the statistics and apply it in your work with affiliates.

And it’s also important to find a solution that works with both mobile and web traffic. It means that all your channels can be covered and that the solution is well experienced in different types and categories of ad fraud.

Contact FraudScore for a free trial and see for yourself how our product is able to save your budgets and keep you reputation on a safe side.”